Best Budgeting Tools: A Comprehensive Guide to Managing Your Finances in 2025

Managing your finances effectively is crucial for maintaining financial health and achieving your goals. Whether you’re looking to save for a big purchase, pay off debt, or simply understand your spending patterns, using the right budgeting tools can make a significant difference. In this article, we’ll explore the best budgeting tools available in 2025 to help you stay on top of your financial situation.

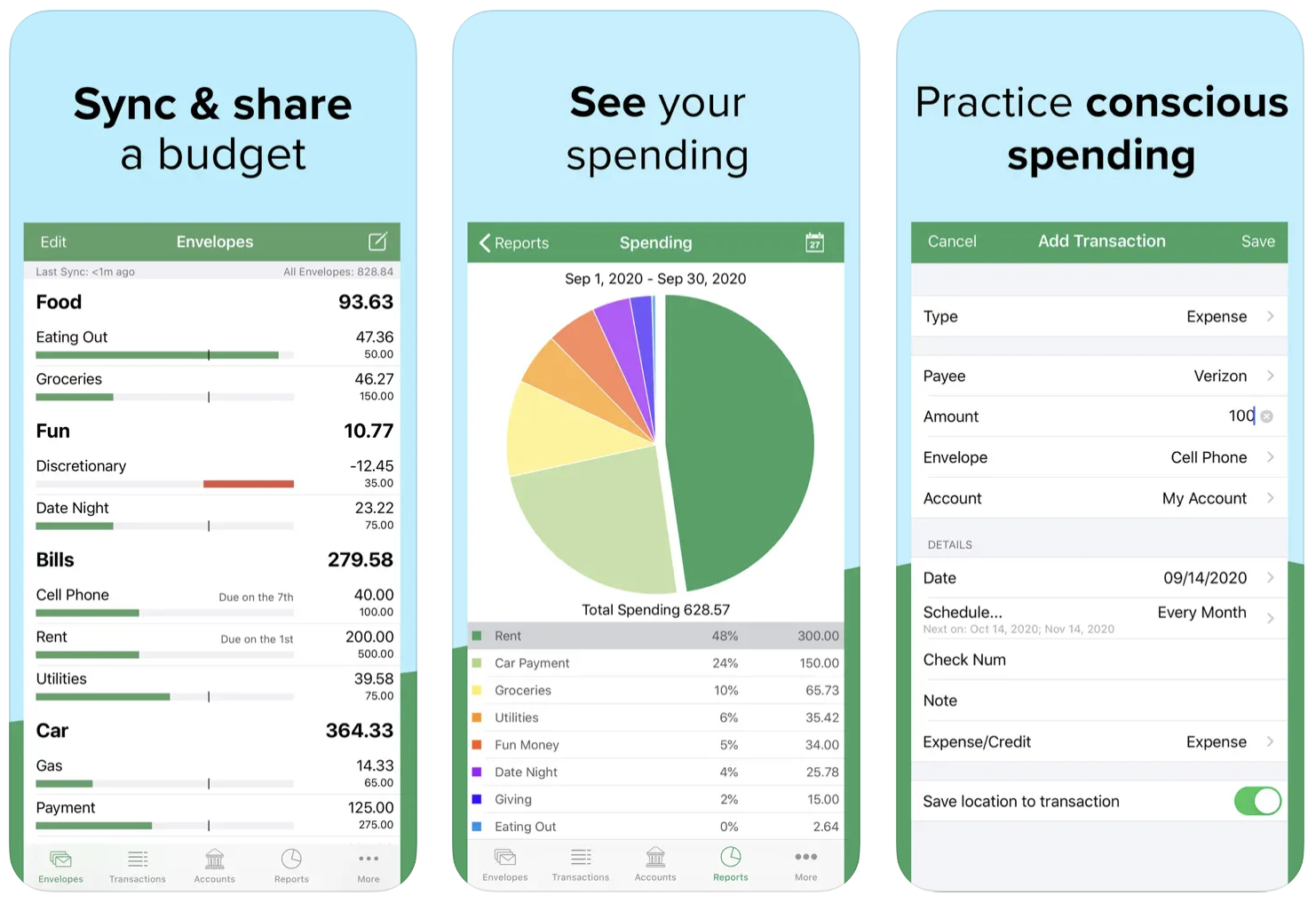

1. Goodbudget: The Classic Envelope Budgeting Tool

Goodbudget is a time-tested envelope budgeting app that helps users allocate their income to different spending categories. The app’s user-friendly interface makes it easy to set up your budget, track your expenses, and save for future goals. Whether you’re saving for a vacation or managing day-to-day expenses, Goodbudget is a great option for individuals who prefer a traditional approach to budgeting.

Key Features:

-

Envelope budgeting method for easy categorization

-

Syncs across multiple devices for convenience

-

Supports cash and electronic transactions

If you prefer a digital version of envelope budgeting, Goodbudget is a fantastic option.

2. Mint: A Comprehensive Financial Tracker

Mint is one of the most popular budgeting apps available. Owned by Intuit, Mint automatically tracks all your bank accounts, credit cards, and investments, consolidating them into one place. Its easy-to-read dashboards provide insights into your spending patterns, income, and savings goals, helping you stay on top of your finances without having to manually input data.

Key Features:

-

Automatic syncing with your bank accounts

-

Categorizes your spending automatically

-

Tracks bills and subscriptions to help avoid late fees

Mint is great for those who want a set-it-and-forget-it budgeting tool that requires minimal effort on your part. Learn more about Mint’s features here.

3. YNAB (You Need A Budget): Budgeting with Purpose

YNAB stands out for its proactive approach to budgeting. Unlike other tools that simply track your spending, YNAB helps you plan ahead by giving every dollar a job. The tool focuses on building good financial habits and prioritizing your spending to match your goals. YNAB’s educational resources are excellent for users who want to become more intentional with their money.

Key Features:

-

Assigns specific jobs to each dollar

-

Provides detailed reports and insights

-

Offers financial education resources

YNAB is ideal for people who want to make a long-term financial commitment and improve their money management skills. You can explore more about YNAB here.

4. EveryDollar: A Simple, Zero-Based Budgeting Tool

EveryDollar is a zero-based budgeting tool that helps you assign every dollar to a specific category. Whether you’re saving for a large purchase or working to pay off debt, EveryDollar simplifies the budgeting process with a clean, easy-to-use interface. With both a free and premium version, it’s a great option for those who want a straightforward approach to budgeting.

Key Features:

-

Zero-based budgeting system

-

Simple drag-and-drop categories for expenses

-

Free version available for basic tracking

EveryDollar is perfect for anyone who wants to focus on spending less than they earn and achieving financial goals. Check out EveryDollar here.

5. PocketGuard: Simplify Your Finances

PocketGuard is a budgeting tool that focuses on keeping things simple by showing you exactly how much money you have left to spend after accounting for bills and goals. With the In My Pocket feature, PocketGuard automatically calculates your available funds after deducting expenses, helping you make smarter spending decisions.

Key Features:

-

Automatically tracks and categorizes expenses

-

Shows your available spending after bills and goals

-

Offers insights into where you can save money

If you’re someone who wants to take the guesswork out of budgeting, PocketGuard is a great choice. Learn more about PocketGuard here.

6. Wally: A Global Budgeting App

Wally is an intuitive budgeting app that allows you to track your spending while also offering support for multiple currencies. Wally’s easy-to-use interface makes it easy for you to record expenses and income on the go. The app also lets you set savings goals, so you can work towards building your emergency fund or saving for a big purchase.

Key Features:

-

Supports multiple currencies for international use

-

Tracks both income and expenses

-

Allows users to set and monitor savings goals

Wally is a great choice for individuals who need a flexible, international tool for managing their finances. You can get more details about Wally here.

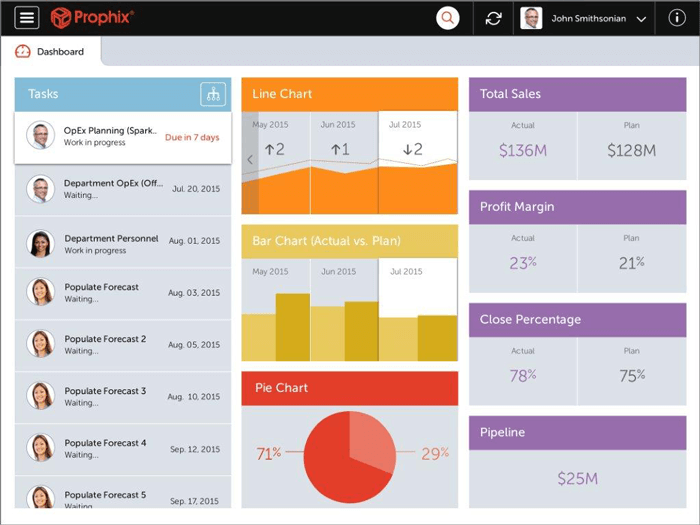

7. Prophix: Advanced Budgeting for Businesses

For those running a business or managing corporate finances, Prophix offers robust budgeting features that help organizations streamline their financial planning. Prophix focuses on automating budget creation, financial analysis, and performance tracking, making it an excellent tool for both large and small businesses.

Key Features:

-

Automates budget creation and forecasting

-

Integrates with accounting software for smooth workflow

-

Provides in-depth financial analysis and reporting

Prophix is ideal for businesses looking to enhance their financial management processes. Learn more about Prophix here.

8. Centage Budget Maestro: Budgeting for Businesses and Enterprises

Budget Maestro from Centage is an advanced budgeting tool designed for businesses and enterprises that need a scalable, reliable solution for financial planning. The software integrates budgeting, forecasting, and reporting capabilities into a single platform. It helps businesses create accurate budgets and improve financial decision-making.

Key Features:

-

Budgeting, forecasting, and reporting in one platform

-

Customizable templates for different industries

-

Helps improve financial decision-making and transparency

Budget Maestro is a top choice for organizations that need to streamline their financial processes and improve accuracy. You can find out more about Budget Maestro here.

9. Tiller Money: Spreadsheet-Based Budgeting

If you’re someone who loves the flexibility of spreadsheets, Tiller Money is the perfect tool. It combines the power of Google Sheets and Excel with the automation of transaction tracking, allowing you to create a highly customizable budgeting experience. With Tiller, you can create your budget exactly the way you want it while still automating data entry.

Key Features:

-

Works with Google Sheets and Excel

-

Automates transaction entry into your spreadsheets

-

Highly customizable budget templates

Tiller is an excellent choice for users who enjoy working with spreadsheets but want to automate some of the tedious tracking tasks. Learn more about Tiller Money here.

10. Simplifi by Quicken: A Streamlined Budgeting Experience

Simplifi is a new tool by Quicken that focuses on simplifying budgeting and providing users with a quick overview of their financial situation. With a clean interface and easy setup process, Simplifi helps users track their spending, set goals, and manage their money with minimal effort.

Key Features:

-

Tracks spending and bills in real-time

-

Goal-setting features to help you save for specific goals

-

Offers a streamlined, easy-to-use interface

If you’re looking for a simple yet effective way to manage your finances, Simplifi is an excellent option. Check out Simplifi by Quicken here.

Frequently Asked Questions (FAQs)

1. What is the best budgeting app for beginners?

For beginners, EveryDollar and Mint are great options because they offer simple setups and intuitive interfaces.

2. Are there any free budgeting tools?

Yes, Mint and Goodbudget offer free versions with essential features for users who want to get started without any upfront costs.

3. Can I track my expenses without linking my bank account?

Yes, apps like Goodbudget and Wally allow you to manually input expenses, so you don’t need to link your bank account if you prefer not to.

4. What’s the difference between YNAB and Mint?

YNAB focuses on proactive budgeting and teaching users how to assign every dollar to a specific category, while Mint automatically tracks your spending and categorizes expenses without much input from you.

Conclusion

Whether you’re managing your personal finances or overseeing a business budget, choosing the right budgeting tool is key to gaining control over your financial situation. Tools like YNAB, Mint, and Goodbudget offer great options for individuals, while Prophix and Budget Maestro cater to businesses. By selecting the tool that fits your needs and goals, you’ll be on your way to achieving financial success.